Content

Note that when the delivery of goods or services is complete, the revenue recognized previously as a liability is recorded as revenue (i.e., the unearned revenue is then earned). Unearned revenue is a liability because there is a chance of a refund. Remember revenue is only recognized if a service or product is delivered, a refund nulls recognition.

Below are three main ways a small business can benefit from unearned income, despite it being a liability. Revenue recognition is one reason why the Financial Accounting Standards Board (FASB) issued the Generally Accepted Accounting Principles (GAAP). GAAP accounting metrics include detailed revenue recognition rules tailored to each industry and business type. Unearned revenue is mainly used in accrual accounting, which recognizes revenue as soon as its earned.

How Tyler Passed His CPA Exams in 5 Months

This type of revenue, for one, provides an opportunity to help small businesses with cash flow and working capital to keep operations running and produce goods or provide services. However, understanding how unearned revenue impacts the books and customer relationships is key to making the most out of this financial component. For these purposes, accountants use the term deferral to refer to the act of delaying recognizing certain revenues (or even expenses) on your income statement over a specified period. Instead, you will record them on balance sheet accounts as liabilities (or assets for expenses) until you earn or use them. You will later move them in portions from your balance sheet accounts to revenues (or expenses) on your income statement.

Thomas has gathered the following information about Brooks’ pertinent accounts. For example, it will allow them to break up their project payments into smaller installments. Say, for example, you can have an agreement with your supplier that if you pay for the services a year ahead, a certain percentage of discount will be given. It is the seller’s choice to prorate the refund or to charge additional fees.

Why is Unearned Revenue a Liability?

Whereas recognized revenue refers to the point at which a booking or deferred revenue becomes actual revenue for your business after delivering on the agreement as promised. Unearned revenue arises when a company receives the payment for a good or service that is yet https://www.bookstime.com/articles/the-accounting-equation-may-be-expressed-as to be delivered or rendered respectively. First, recording customer deposits as revenue doesn’t accurately reflect the company’s financial position. For example, say you collect a $5,000 deposit from a customer in December and recognize the full payment as revenue.

- It is the seller’s choice to prorate the refund or to charge additional fees.

- Unearned rent refers to the money received in advance by a landlord from renters of his property.

- Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a customer for products or services that will be delivered at some point in the future.

- In accrual accounting, you only recognize revenue when you earn it, unlike in cash accounting, where you only earn revenue when you receive a payment period.

- It’s also useful for investment purposes, as unearned revenue can often provide fresh insight into a company’s potential future revenue.

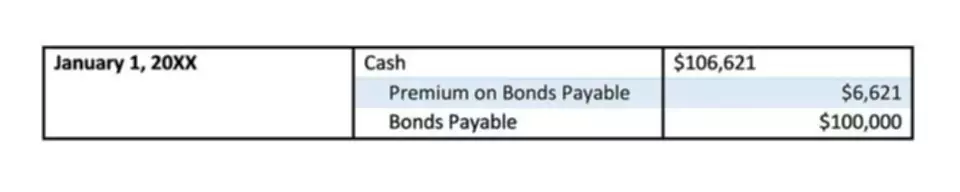

Journal entries are summaries of transactions that affect individual account balances. These entries are the primary sources of information for the preparation of financial statements such as the balance sheet and income statement. Common types of journal entries are adjusting and closing entries. Unearned rent refers to the money received in advance by a landlord from renters of his property. Deferred revenue is the revenue you expect from a booking, but you are yet to deliver on the account’s agreement. Thus, even though you received the revenue in your account, you cannot quite count it as revenue.

Need Accounting Help?

For instance, when a client makes an advanced payment for products or services the company needs to deliver in less than 12 months, then it becomes a current liability. However, when the obligation cannot be fulfilled within 12 months, then the respective unearned is unearned revenue a current liability revenue can be recognized as long term liability. As the company is delivering the services or the product over time gradually, then the prepaid amount is being earned by the company, and it is recognized as revenue on the company’s income statement.

Is unearned rent income a liabilities?

Unearned rent refers to the money received in advance by a landlord from renters of his property. This is considered a liability on the part of the landlord because he is yet to render the service to the client.

In this case, the company ABC needs to record the $2,000 of cash received as an unearned rent revenue in the journal entry on December 29, 2020. In this case, the company can make the journal entry with the debit of the unearned rent revenue account and the credit of the rent revenue account. This landlord has accounted for the receipt of cash from the tenant for last month’s rent as unearned rent. However, a different way to view the same transaction is by accounting for it as deferred revenue.

Recommended explanations on Business-studies Textbooks

A reversal, will adjust the liability and move the money through to income, do NOT do that. In the case of subscription services, revenue installments are made at different times during the contract. For annual contracts, a prepayment is made at the beginning of the period.

Once revenue recognition occurs, it is earned revenue and becomes income. The accounting noted here only applies under the accrual basis of accounting. Under the cash basis of accounting, the landlord does not have any unearned rent. Instead, any rent payments received are recorded as income at once. In many cases, any unearned revenue on your books will be a short-term liability (also known as a current liability) because you expect to earn the revenue within the current accounting period—usually within the next 12 months.